Not a loan officer? Visit our careers page

Diverse loan programs that help more borrowers

Innovative technology to streamline the process

Strong fulfillment that enables you to deliver results

Reach more prospects with creative, in-house marketing tools

Lock and shop gives your clients an extended

time to find their dream home

time to find their dream home

TrueApproval offers borrowers a full credit approval

while still house shopping

while still house shopping

Reduce initial monthly payments with

our temporary buydown option

our temporary buydown option

Better tools, more success.

See how today!

Tools for success

Let's connect

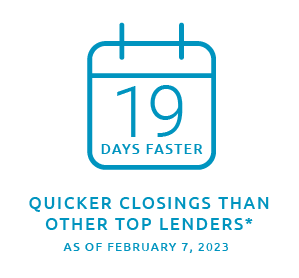

*Source: Lender’s Benchmark averaged number of calendar days between application to close and lock to close for purchase and refinance transactions compared to the market four weeks to date through 2/3/23. Currently participating Retail lenders in the LendersBenchmark system: Amerifirst Home Mortgage, Amerihome Mortgage, Cardinal Financial Group, Celebrity Home Loans, Cornerstone Home Lending, CU Home Mortgage, DHI, Embrace Home Loans, eMortgage Management, Envoy, Evergreen Home Loans, Fairway, Finance of America, First Guaranty Mortgage Corporation, Freedom Mortgage, Gateway First Bank, Guaranteed Rate, Guild Mortgage, Homebridge Financial Services, Homeowners Financial Group, Intercoastal Mortgage, Loan Depot, Mortgage Investors Group, Mortgage Network, Mr. Cooper, Mountain West Financial, NewRez (includes Caliber), OnQ, PennyMac, Prime Lending, Redfin, Sierra Pacific, Stearns Lending, Supreme Lending, and Waterstone Mortgage